1099 Tax Forms Sales/UseTax Requirements

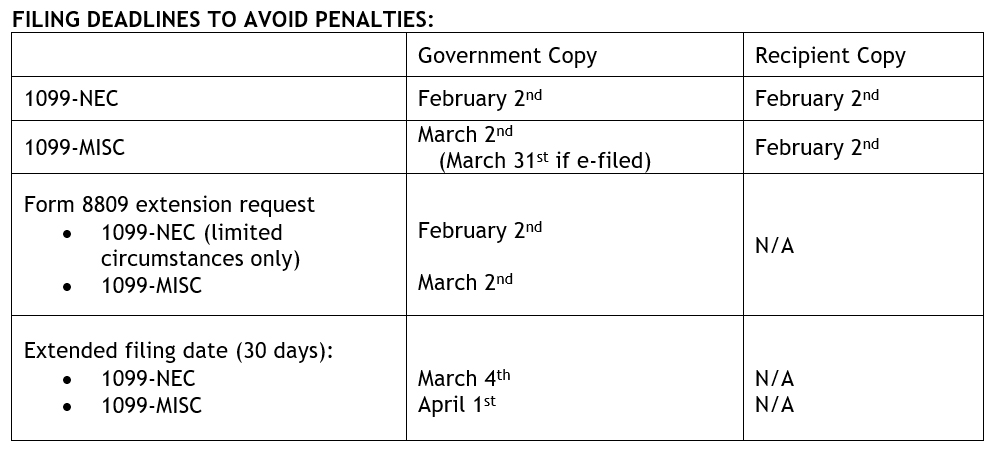

It is the time of year to begin planning and preparing for the issuance of your company’s 1099s by February 2, 2026. As a reminder, here are some general guidelines and deadlines to keep in mind:

- FORM 1099-NEC: You must file Form 1099-NEC, Non-Employee Compensation, to report payments for services to independent contractors.

• Which payments are reported on Form 1099-NEC?

○ The payment is made to someone performing services as a non-employee during 2025.

○ The payment is for services performed in the course of the entities’ trade or business (nonprofits are considered to be engaged in a trade or business and should use Form 1099-NEC).

○ The payment is for $600 or more for the year.

○ Any payment made to anyone from whom they withheld federal income tax, even if the payment was under $600.

• Amounts noted above that are paid to corporations are not reportable, even if they exceed the applicable threshold. The only exception is that payments for legal services to a corporation must be reported.

○ Note that partnerships and LLCs are not corporations and should receive a 1099-NEC if payments to them exceed any of the thresholds that are mentioned in this memo.

○ Please note that Sassetti LLC is not a corporation and, therefore, fees of $600 or more paid to our firm in the course of your business during 2025 must be reported. If you need Sassetti’s EIN, call our office at 708-386-1433.

- FORM 1099-MISC: You must file Form 1099-MISC, Miscellaneous Information, to report certain payments you make in your trade or business, as follows:

• Payments of $600 or more for:

○ Prizes and awards (i.e. Raffles, lotteries, TV or radio winnings, etc.) (report in box 3)

○ Other income payments (report in box 3)

○ Medical and health care payments, even if paid to a corporation (report in box 6)

○ Gross proceeds paid to an attorney (report in box 10)

○ Rent, other than rents paid to real estate agents (report in box 1)

• Royalty payments of $10 or more (report in box 2).

• Direct sales by you of $5,000 or more of consumer goods to a person for resale anywhere other than a permanent retail establishment (report in box 7).

• Federal income tax withheld under the backup withholding rules (report in box 4).

• Amounts noted above that are paid to corporations are not reportable, even if they exceed the applicable threshold.

• Any 1099-Misc Forms with amounts in Box 8 (substitute payments in lieu of dividends or interest) or Box 10 (gross proceeds paid to an attorney), or 1099-B or 1099-S Forms have an extended recipient filing date of February 14, 2026.

- FORM 1099-DIV, 1099-INT and 1099-R: Dividend, interest and retirement payments are also required to be reported. If you made any of these payments in the course of your business in 2025, please contact our office for information about filing the appropriate form. Other industry specific 1099s are also required to be filed. If you are not sure if these miscellaneous 1099 forms might apply to your business, please contact us with your questions.

- ASSESSING INDEPENDENT CONTRACTOR STATUS:

• Always carefully consider whether an individual is an independent contractor or actually an employee with respect to your business. If an employee is incorrectly classified as an independent contractor, the employer can be held liable for employment taxes for that worker.

• Worker classification between employee and contractor continues to receive increased scrutiny from the IRS and the Illinois Department of Employment Security.

• As you determine the appropriate classification for your contractors, we encourage you to carefully consider the factors indicating that they are available for business to others (listed business telephone number, website, can be found via an internet search, control of work responsibilities and hours, etc.).

• Obtain a completed Form W-9 for every vendor that you use prior to making the first payment. This form is necessary to determine if a 1099 needs to be issued and contains the necessary tax identification number.

• If you do not have a W-9 form on file for any of your current vendors, you should consider obtaining one from them prior to making your next payment in order to determine if you have any 1099 reporting requirements for any vendor in 2026. A copy of a blank W-9 is included for your reference.

- COMMON MISTAKES TO AVOID:

• Include only payments made during the calendar year 2025.

• Include only payments for services.

• Do not send the same information to the IRS more than once.

• Amounts reported should include dollars and cents.

• Do not submit two or more types of 1099 returns with one Form 1096.

-

ILLINOIS SALES/USE TAX REQUIREMENTS:

In addition to 1099 planning, now is also a good time to consider any Illinois state sales tax that you might be required to self-remit. The state of Illinois requires that state sales tax be paid on all purchases which are not intended for resale, and therefore have been used by you or your business. In some cases, items are purchased from out of state vendors that do not assess sales tax at the time of purchase. In other cases, items which were purchased with the intent to be resold are later used or consumed by the business and hence would be subject to sales tax (use tax). It is important to review your purchases for any such items, including fixed assets, so that the proper tax is calculated and paid.

Footer

Sassetti LLC © 1921-

2026