Inventory Costing Guide

Choosing the Right Inventory Costing Method for Your Business

In the world of finance and accounting, inventory costing plays a crucial role in determining a company’s financial health and profitability. Understanding what inventory costing is and how it impacts your business can empower you to make informed decisions that optimize your bottom line. In this comprehensive guide by Sassetti, a leading accounting firm, we delve into the fundamentals of inventory costing, explore its significance, and shed light on various methods used to calculate and manage inventory costs.

Understanding Inventory Costing: A Key Financial Metric for Business Success

Profitability Analysis

By calculating the cost of goods sold (COGS) accurately, businesses can determine their gross profit margins. This information aids in assessing the financial viability of specific products, pricing strategies, and overall profitability.

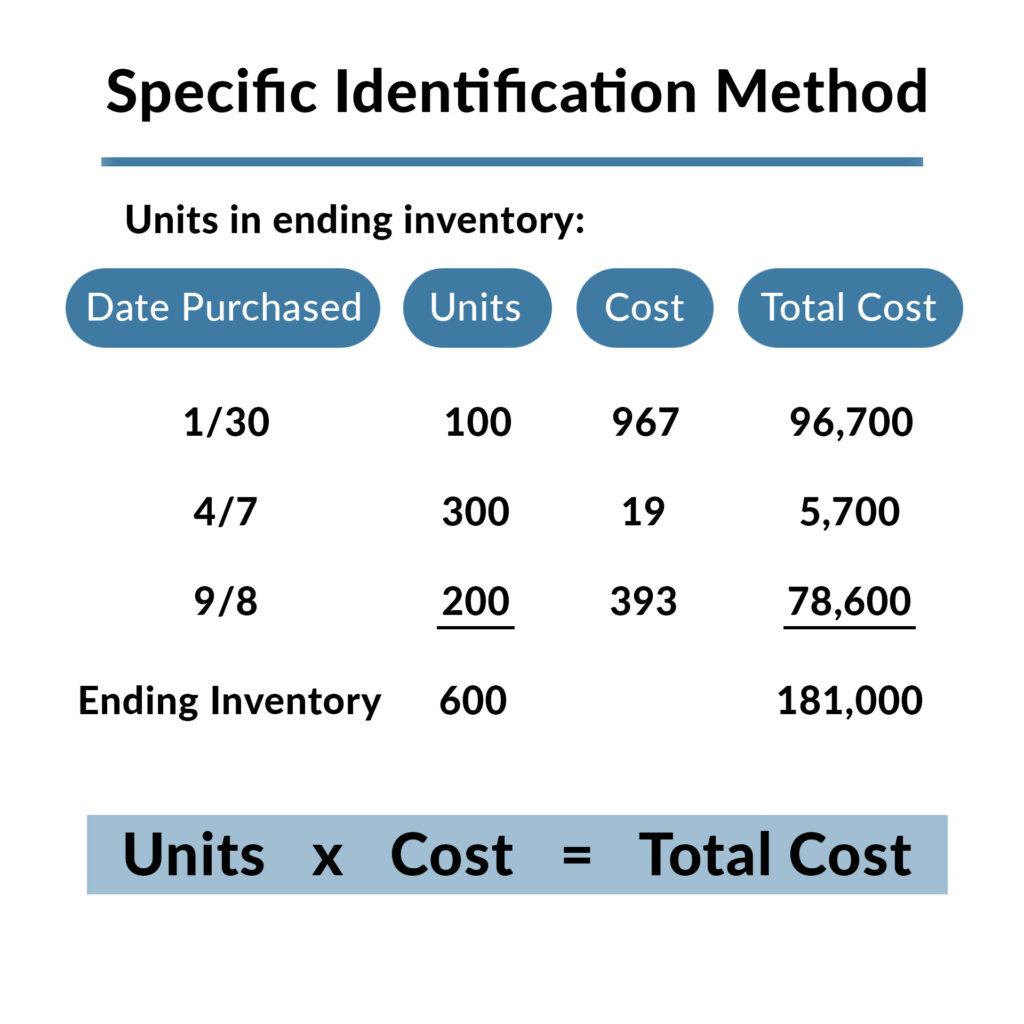

Methods of Inventory Costing

Several methods are used to calculate inventory costs. The choice of method depends on various factors, including industry norms, business size, accounting requirements, and tax implications. Here are some commonly used inventory costing methods:

Inventory Costing Goes Beyond Financial Management

Meet The Experts

Our team members have spent a lot of time problem-solving for a variety of industries. Their expertise is unmatched and they are driven and excited about new challenges.