INVENTORY CONTROL: The Standard Cost Inventory Valuation System Series

Setting standard costs involves planning and estimating what you expect to spend on producing a product or delivering a service. Here’s a step-by-step guide to help you understand how to set these costs:

Step 1 – Define the Scope

Identify the Product or Service

Determine the specific product or service for which you are setting the standard cost.

Step 2 – Determine Cost Elements

Standard costs are typically broken down into three main categories:

Materials: Cost of raw materials and components.

Labor: Cost of employee wages

Overhead: Indirect costs such as utilities, rent, and administrative expenses.

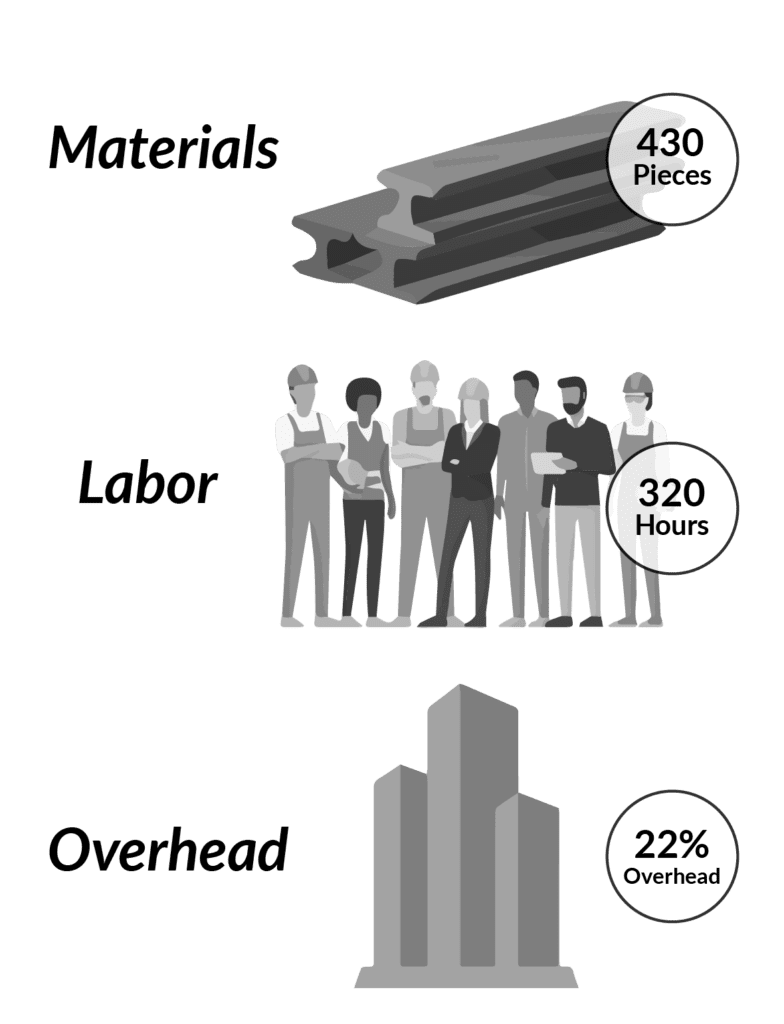

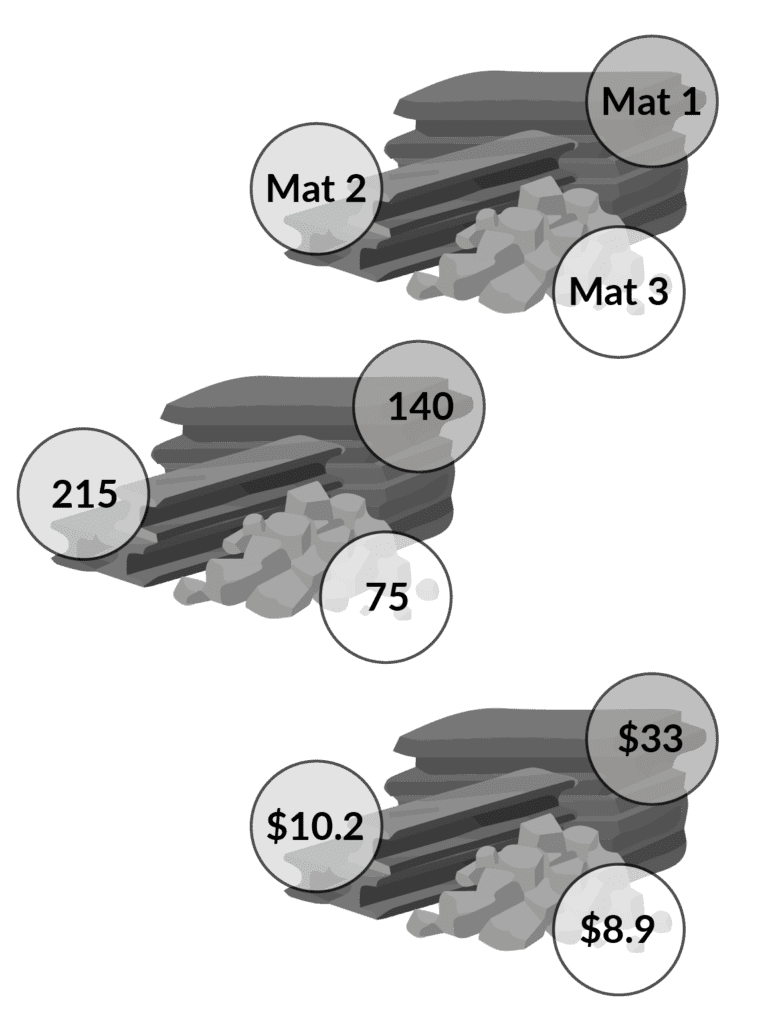

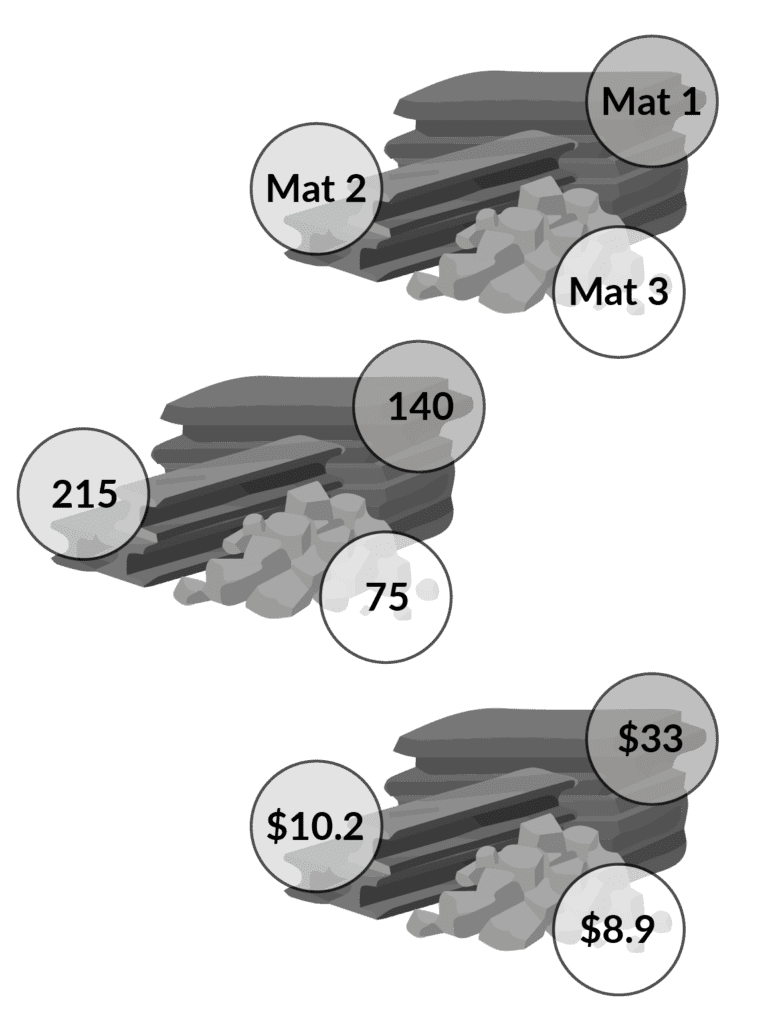

Step 3 – Determine Volume Elements

Materials: How much of each raw material does the specific product require

Labor: Time spent to produce the specific product or service

Overhead: Absorption method (machine hours, labor hours, etc.)

Step 4 – Calculate Material Costs

List Materials: Identify all materials required for the product or service.

Estimate Quantities: Determine the quantity of each material needed.

Set Prices: Estimate the cost per unit of each material, based on historical data, supplier quotes, or market research.

| Material | Quantity Required | Cost per Unit | Total Cost |

|---|---|---|---|

| Flour | 2 lbs | $2/lb | $4 |

| Sugar | 1 lb | $1/lb | $1 |

| Eggs | 2 dozen | $0.50/dozen | $1 |

Step 5 – Calculate Labor Costs

List Tasks: Identify the tasks required to produce the product or deliver the service.

Estimate Time: Determine the amount of time each task will take.

Set Wage Rates: Estimate the cost per hour for each type of labor involved.

| Task | Time Required | Cost per Hour | Total Cost |

|---|---|---|---|

| Mixing Ingredients | 0.5 hours | $20/hour | $10 |

| Baking | 1 hour | $20/hour | $20 |

| Decorating | 0.5 hours | $20/hour | $10 |

| Total Cost | $40 |

Step 6 – Calculate Overhead Costs

Identify Overheads: List all indirect costs associated with production or service delivery.

Overhead costs include all indirect costs that cannot be directly traced to a specific product or service. These fall into two categories:

Variable Overhead Costs: Costs that vary with the level of production (e.g., indirect materials, utilities).

Fixed Overhead Costs: Costs that remain constant regardless of production levels (e.g., rent, salaries of permanent staff).

Allocate Costs: Allocate these costs to the product or service based on a logical method, such as machine hours, labor hours, or units produced.

Allocate Overhead Rates: The predetermined overhead rate is used to apply overhead costs to products. It is calculated separately for variable and fixed overheads.

Example:

Budgeted Fixed Overhead Cost: $2,000 (Rent) | Budgeted Labor Hours: 1,000 hours | Fixed Overhead Rate: $1/hour

| Example Determination of Overhead Cost Rate: | ||||

|---|---|---|---|---|

| Overhead Item | Budgeted Labor Hours | Total Cost | Allocated Cost | Cost Based on Budgeted Labor Hours (2) per unit |

| Utilities | 1,000 | $1,000/year | $1/labor hour | $2 |

| Rent | 1,000 | $2,000/year | $2/labor hour | $4 |

| Purchaser – Salary | 1,000 | $5,000/year | $5/labor hour | $10 |

| Total Cost | $8/labor hour | $16 |

Step 7 – Consider other variable input costs

Freight: Shipping and handling paid to purchase inventory can be added to the standard cost per unit

Storage: Costs to store inventory are considered a cost of inventory and can also be added to the standard cost per unit

Step 8 – Combine Costs

Add up the material, labor, and overhead costs to get the total standard cost for the product or service:

| Cost Element | Total Cost |

|---|---|

| Material | $6 |

| Labor | $40 |

| Overhead | $16 |

| $62 |

Step 9 – Review and Adjust

Historical Data: Compare with past data to ensure accuracy.

Market Conditions: Consider current market conditions that might affect costs.

Consult Experts: Get input from production managers, procurement teams, and financial analysts.

Step 10 – Implement and Monitor

Document Standards: Clearly document the standard costs for reference.

Monitor Variances: Regularly compare actual costs to standard costs and investigate any significant variances.

By following these steps, you can set realistic and practical standard costs that will help you manage and control your expenses effectively.

Part I

Introduction to the

Standard Cost Method

Part III

Defining Standard

Cost Variances