Nonprofit

From accounting and bookkeeping to financial reporting and compliance, we are dedicated to providing top-quality services that help our clients thrive.

Help Achieving Your Mission

At Sassetti, we specialize in providing expert financial services to help nonprofit organizations efficiently support their causes. Whether you need us to serve as your auditor or provide accounting support, our team of experienced professionals is here to help. We can work with your current auditor to take over responsibility for your accounting systems or manage your in-house accounting team. For some clients, we serve as a fractional or part-time CFO or Controller, providing the financial leadership and strategic guidance needed to achieve your mission. With our in-depth knowledge and understanding of the nonprofit community, we deliver the specialized expertise and insights you need to succeed. Let us help you achieve your goals and make a difference in the world.

Our Nonprofit Focused Solutions:

Audits, Including Single Audits

Sassetti provides expert audit services for accurate, compliant financial statements, identifying areas for improvement. Our comprehensive reviews, including specialized single audits for nonprofits, offer customized solutions and ongoing support to address any issues and ensure regulatory compliance.

Agreed-Upon Procedures

Our Agreed Upon Procedure (AUP) services for nonprofits assess specific financial or operational areas, offering independent, targeted insights. With expertise in accounting and financial analysis, we design efficient procedures to address key concerns, identifying and resolving any issues promptly.

Internal Controls & Fraud Prevention

Leveraging our accounting and financial expertise, Sassetti offers tailored solutions to identify risks, strengthen internal controls, and prevent fraud. We collaborate with clients to create compliant, effective policies that address specific challenges, with ongoing support to ensure controls stay robust and risks are managed proactively.

Audits of 403(b) and Retirement Plans

We offer specialized audits for nonprofit 403(b) and retirement plans, ensuring regulatory compliance and accurate financial reporting. Our expert team conducts thorough, efficient audits tailored to meet both regulatory and operational needs, promptly identifying and addressing any issues to support effective plan management.

Accounting Department Outsourcing

Our firm provides customized solutions, including accounting, bookkeeping, financial reporting, and compliance. Our experts help design and implement financial management policies that strengthen internal controls and ensure compliance. Partnering with us lets you focus on your core mission while we efficiently manage your accounting needs, delivering greater financial transparency and accountability.

Fractional or Part-Time CFO or Controllership Support

Sassetti provides fractional CFO and controllership services to optimize your financial management affordably. Our tailored solutions offer strategic financial guidance, budgeting, forecasting, analysis, and risk management aligned with your business goals. With our flexible, cost-effective support, you gain the expertise to enhance financial performance and drive growth.

990 Return Preparation & Filing

As a nonprofit organization, filing Form 990 is an essential part of your compliance obligations. Sassetti provides tailored 990 return preparation and filing services specifically for tax-exempt organizations. Our team of tax experts has in-depth knowledge and experience in navigating the complex tax regulations that govern Form 990 filings. Ensure that your return is accurately prepared and filed on time will give you peace of mind and allowing you to focus on your mission.

Support with Transparency

Filing Form 990 is essential for nonprofit compliance, and Sassetti offers specialized preparation and filing services for tax-exempt organizations. Our tax experts bring in-depth knowledge of the complex regulations governing Form 990, ensuring accurate and timely filings, so you can focus on your mission with peace of mind.

Unrelated Business Income Tax (UBIT) Support

Unrelated Business Income Tax (UBIT) can be challenging for nonprofits, and our team offers guidance to ensure compliance and minimize tax liabilities. With extensive experience in nonprofit tax issues, we help identify and address UBIT concerns, providing support with tax planning, compliance, and dispute resolution.

Exempt Status Applications

Sassetti supports organizations in obtaining and maintaining tax-exempt status, guiding you through the complex application process. We handle documentation, IRS submissions, and provide ongoing support, with a proven track record of helping nonprofits secure and sustain their exempt status.

Consulting on Governance Issues

We offer expert guidance on governance, including board composition, bylaws, policies, conflict of interest, and best practices. Our experienced consultants provide tailored solutions to help nonprofits navigate governance challenges and build a solid framework for effective decision-making, strengthening your operations to achieve your mission.

Cash Flow Planning & Operational Consulting

Sassetti provides cash flow planning and operational consulting to help nonprofits manage finances and plan ahead. We identify areas for improvement and implement strategies to boost efficiency, reduce costs, and strengthen financial health. Understanding the unique challenges nonprofits face, we deliver personalized solutions to support your organization’s goals.

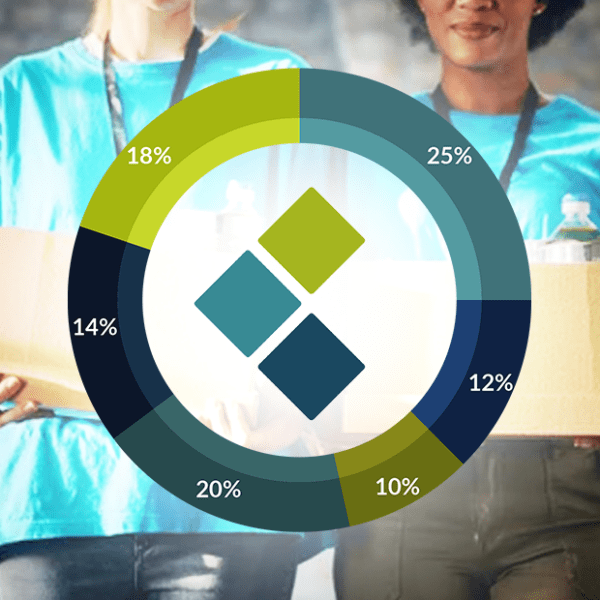

2024 NONPROFIT BENCHMARK STANDARDS

Meet The Experts

Our team members have spent a lot of time problem-solving for a variety of industries. Their expertise is unmatched and they are driven and excited about new challenges.